Man pulling out of empty pocket.

Knowing that you are going to have to get a loan is not exactly relaxing. The process of getting a loan is not as easy as many people make it out to be; you have to consider so many things.

We are going look at the various steps you have to go through, as well as the options that are available to you.

Short-term versus long-term loans

When people compare two types of loans, they are usually comparing risks. It is rare that two types of loan can be fairly compared in this way however. Everyone has a unique situation, so the relative benefits and risks are not always so easy to compare.

Two broad categories of loan that you should be considering at first are short-term and long-term. A short-term loan tends usually has to be paid back over the course of around three years but the phrase can also be used to describe loans that need to be paid back in just a few months. Long-term loans tend to see things in chunks of five to ten years. Ten years, fifteen years, twenty years, and more are common time limits.

What determines what kind of term loan you are more likely to get? It tends to rely on the lender’s confidence in you. Long-term loans may seem safer in some respect but a lot can happen in such a long amount of time. The lender needs to be confident that your financial status, employment status, or your living status will not be changing any time soon. There also needs to be a certain degree of confidence in the economic climate. Short-term loans require that the lender be confident that you will pay the money back soon. It is usually much less of a risk for the lender.

Amounts and costs among the ‘terms’

If you are looking for a loan, you are probably looking for quite a substantial sum. Some people will have valuable assets that can act as a safety net if something goes wrong. However, this is not the case for most people. Thankfully, this does not mean that they are shut out when it comes to long-term options. They will usually pay higher interest rates although it is worth pointing out that some short-term loan interest rates will exceed these.

Homeowners may have to put their home down as equity. If the payment is not made within the agreed period, the house could be at risk – not a situation many homeowners can afford to put themselves in. Ultimately, long-term loans offer a lot more flexibility when it comes to payment options, even if those options are not particularly appealing.

Interest rates among the two

Interest rate

Many people prefer short-term loans because overall cost is much lower. Interest rates do not get astronomical when you go for options that need to be paid back within two or three years. This has a lot to do with the lessened risk on the part of the lender.

The downside, of course, is that the amount of money you can get from a short-term loan is nowhere near as high. Huge short-term loans are usually restricted to large businesses. At the end of the day, the loan amount will probably determine which option you should go for.

Many other factors will also play a large part, such as your income and your credit rating. (We are going to look at that a bit more in a bit.) Whatever you do, you should not take out a loan unless you are confident you’ll be able to pay it back. Be it in a month, a year, five years, or twenty, returning the money is your key concern once you have gotten the load.

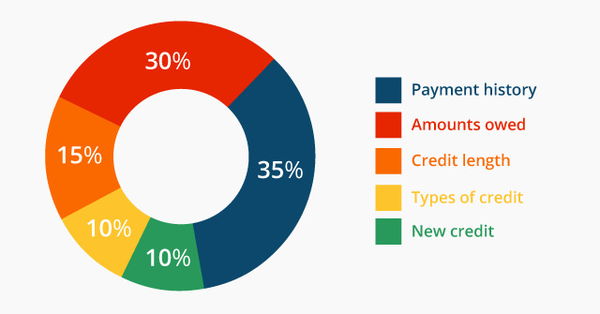

Credit score breakdown. Image Source.

The need for speed

Those in need of a loan often need it as quickly as possible. It is in your best interests that you ensure all potential roadblocks are removed before you actually apply for the loan – and the potential roadblocks are certainly many.

The fastest way to rid yourself of these roadblocks might be to skip credit card checks. There are actually lenders out there who will loan you money without requiring a credit check. However, the problem is that the initial fee is usually incredibly high with this kind of loan. This helps the lender offset some of the risk. You also probably will not able to get your hands on anywhere near as much. It is best to make sure any real issues are actually resolved.

The red flags for lenders

Most people are aware of a few credit check problems such as already being in debt, a history of not paying money back, etc. However, there are a few other reasons that a credit score might be low that you have not considered.

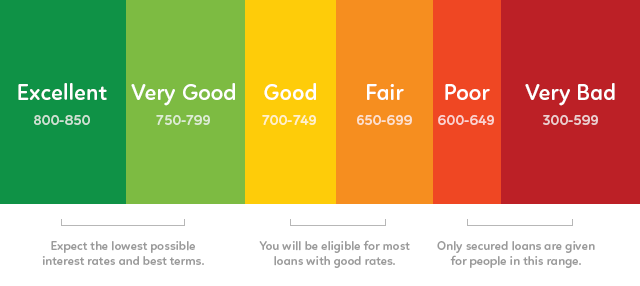

FICO Credit Score Range. Image Source.

Let us take identity theft, for example. Such a practice can be more widespread than you may think. When it happens, it is not always obvious. Experts have gone as far as to claim that everyone should assume that their information has already been compromised! Ensure that you check your bank statements and credit files regularly and thoroughly. If an identity thief has been posing as you in certain institutions or messing with your assets, this will affect your credit score.

Did you know that your social media account could also doom you to not being able to get a loan? Most people do not know this but it makes sense when you think about it though. It gives lenders an idea of the type of person to whom they are thinking of lending money. Social media and other online activity can help lenders get detailed data on things like mobile phone use and purchasing behavior. Facebook and Twitter accounts are adverts for the sort of the person you are. They also reveal the sort of company you keep. It is important that you try to gauge exactly how a potential lender might interpret your online activity.

Having no money is also a problem, though one that many people are surprised to discover is a problem. After all, if someone is trying to borrow money, it is likely that he has no money, right? Well, not quite. The fact is that lenders will want you to have some funds at hand. After all, there will be administration costs and perhaps other down payments to consider. Besides, you having money at hand means it is more likely you will be able to make more money going forward. This is crucial – after all, when you make money, they are assured that they are going to be paid back!

The easiest loan you can get your hands on?

It should be clear by now that getting a loan is not a piece of cake. It is a complex process that involves a lot of consideration and investigation on your part, as well as that of the lender. Not everyone has the luxury of time, however. Some people just need a quick cash injection to see them through a very short period. In such a case, someone may look at the loan that is often the quickest and easiest to get while still requiring credit checks: a payday loan.

“Payday loans” has become something of a dirty phrase to many people. Some would say that they are immoral; that the lenders are predatory, and the interest rates designed to keep you in debt for as long as possible but this tends to betray a vast misunderstanding of how the lending industry operates.

Payday Loans.

Looking out for yourself

Much of the advice we are going to go through here applies to the hunt for any kind of loan. However, we are going to put particular focus on people looking for short-term loans. This is because people looking for these sorts of loans are often much more vulnerable.

The fact is that even if you are in a rush to get some cash to hold you over for a short time, you still need to take some time to go over your options. Many people in the short-term loan business are just waiting for someone desperate to walk through their doors so they can begin taking advantage of them. Therefore, you need to ensure that you are actually working with a reputable lender. Otherwise, you may get yourself into a nasty debt situation with a ruthless lender.

If there are any other ways you can get money without having to go to a commercial lender, then you should consider it. (If it is legal, of course!) For many people, this means that they have to review the possibility of asking friends or family for help. Many people do not like the thought of this. Many are embarrassed to reveal such problems to the people they are close to. That, or they just do not want to put their loved ones in the sort of position where they feel pressured to give a particular answer.

Final thoughts

You see what I mean about the complexity of loans? Yes, you may be in an unpleasant or even desperate situation but you definitely should not be rushing into anything. There are so many things to consider. Take your time and do not be afraid to reach out to others.